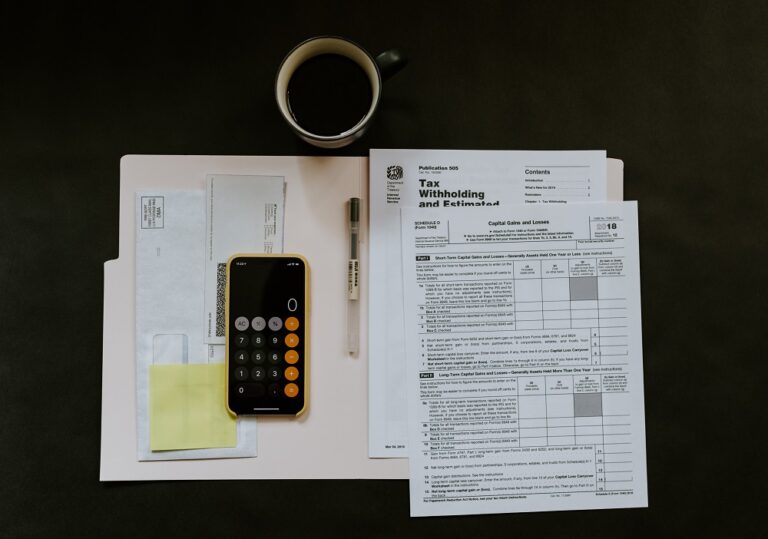

Exit Planning Strategies for Attorneys: How a CPA Can Help

When attorneys consider retiring or changing careers, exit planning becomes essential. An exit plan provides a clear path for transitioning out of your practice, ensuring that you secure the best possible outcome for your years of dedication. A Certified Public Accountant (CPA) can be instrumental in this process. With their expertise in financial analysis, tax…